The world changed in 2020. That means your marketing budget will still look different in 2021.

Is it time for your credit union marketing budget to get an update? Probably yes – but any update needs to account for recent changes in marketing and member habits, and current events. As you step into 2021, don’t forget to bring the lessons learned from 2020. There’s a new year on the calendar. Unfortunately, that does not mean everything has changed.

Think back to where you were in January 2020. With a fresh year ahead, you and your credit union set the goals that would take you through the year, and a marketing budget to match. Perhaps you hoped to bring more people into your branches and had the idea for a communications campaign that would generate interest around in-person visits. Or maybe your goal was to strengthen internal communications and talent. Together with your team, you mapped out the different workshops and conferences you hoped to attend. Another goal might have been to deepen your community roots, and involved hosting a large event or sponsoring a youth sporting team.

But whatever hopes you had for 2020, and whatever marketing budget you had to match, the year required a pivot. So, what happened to the time and resources allotted to that in-branch campaign or conference travel?

Although we are starting 2021 with hope and ambition for a brighter year ahead, the effects of 2020 are still being felt. Your members, coworkers, and community have all encountered the financial and emotional impact of living through a pandemic, social and political change, and economic turbulence. What’s next? While we can come up with some ideas for the future, nothing is set in stone.

Our advice: With savvy planning, you can make the most of your credit union marketing budget to adapt to the times.

Bundle Up. It’s Winter.

Oftentimes, the path to creating (and ideally achieving) your goals comes with pre-goals. In other words, there are mini goals to hit in order to be able to successfully tackle the big goal. For example, if a personal goal is to start exercising more, a pre-goal or mini goal to take care of first is finding an exercise routine that works or even buying running shoes. Ensuring you have the tools and resources needed to work toward your goal is critical in actually achieving the goal.

Back in December, we talked about winterizing your credit union. With a new year around the corner, winterizing is the work that ensures a smooth change of seasons. If you knew that in 2021 you hoped to explore new avenues on social media, the end-of-year homework you needed to accomplish was auditing your accounts. So, did you remember to on the snow tires and lock the storm windows? Or, in social media marketing terms, did you update your passwords, make a list of account names, and take a look at your most successful or unsuccessful posts?

If you did, you are already off on a strong start. But if you didn’t, don’t despair…there’s still plenty of time for work in 2021. Use January to start chipping away on the mini tasks that will help the rest of the year go smoothly. This time of year naturally becomes a time for exercises, cleanses, and healthy habits. Take the opportunity to reassess what assets you have heading into the new year and what you would like to keep in 2020.

Budget Tip: Reallocate Resources

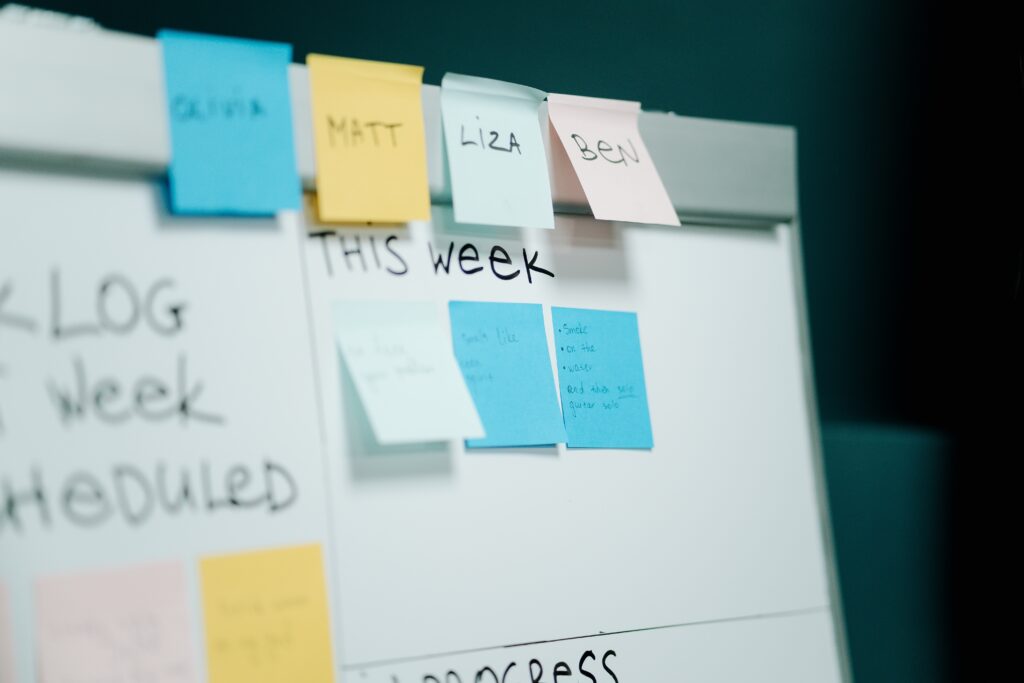

With 2021 in focus, it is a great time to have conversations about hopes and anxieties related to the year ahead. In planning with an eye on your credit union marketing budget, it is important to be honest with yourself and your team. Even though we are in a new year, a lot of old issues and concerns are coming with us. Make your budget priorities appropriate for the year we live in.

What does this mean? Top of mind should be digital communications. Virtual events will be continuing for the foreseeable future, so reallocate the money that might have gone to conference travel or large-scale in-person events to better serve your members and team. Where can you expect to meet people and gather your community instead in 2021? Online.

Whether thinking about shopping, learning, work, or connecting, digital is the answer. Already, the credit union industry was experiencing a digital shakeup before the pandemic forced certain actions. This year, think about what you can plan for – instead of reacting later. Does your website have a live chat function? Do you have a healthy email list? Is there someone at your credit union who can help create insider content? Social media, digital ad spends, and responsive websites are no longer optional in 2021.

Focus on Creative Solutions

If you haven’t picked up on the message by now, your 2021 credit union marketing budget should focus on digital. But while having a digital strategy is great, it shouldn’t be thought of as something extra. The digital strategy is the strategy.

What does this mean? Digital is no longer a department to itself. Complicated times call for creative solutions, so involve everyone. Whatever the role and whatever the department, digital should be top of mind. And everyone is on the digital team. Think of your social media and online marketing as part of an overarching digital branch. For example, if you have a team member who works in one physical branch, but appears on your social media videos or contributes to an e-newsletter, they are part of the digital branch.

This message, to be present virtually and follow digital leads, needs to come from the top, sides, and all parts of your credit union. A huge part of effective and appropriate employee engagement online comes from being properly trained and empowered. Does your credit union staff have the tools and resources needed to understand working in the online world? Consider offering training or a helpful social media handbook to educate and uplift the team.

Continue to Build Community

In marketing terms, 2021 is expected to be a year of micro-influencers and brand ambassadors. But let’s translate that to credit union terms. 2021 is a year of continued connection and community. Together, we’re adapting and rebuilding. Fortunately for credit unions, community is a natural part of the long-term mission. So, put your people first!

How can people come first when everything is digital and people avoid gathering together in person? It comes back to personalizing. Even though online sounds like a sort of nebulous place, there is a great need to have a face (or faces) represent your credit union online. Investing your credit union marketing budget in the right campaign materials for 2021 is key. It’s time to update your messaging and photos to reflect the times we live in. That means using photos that reflect social distancing and health concerns.

It also means speaking to life concerns. Are your members experiencing unemployment, or are they starting the recovery process? This could change from branch to branch or person to person, and even change again throughout the year. The best way to handle a community with complex needs: Listen and take action. If 2020 was the year of quick responses and promises for a better tomorrow, then 2021 is the year to make visible changes.